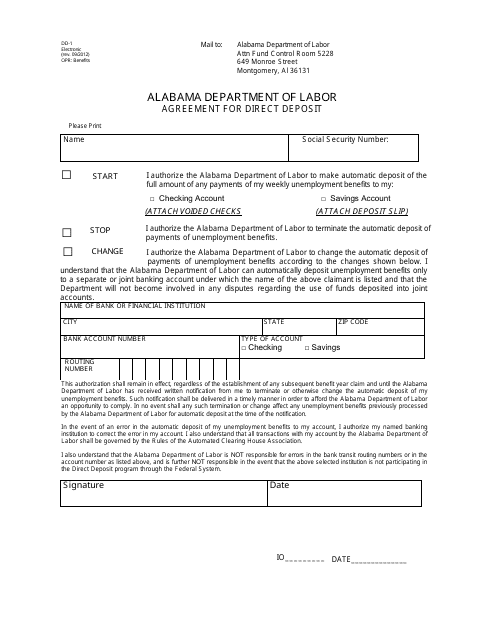

The Alabama Department of Labor is always striving to better serve our customers throughout the state. Learn more about Form 1099-G and how it affects your taxes. To make an online payment via electronic funds transfer from a checking or savings account towards an outstanding Unemployment Compensation Overpayment balance or to view the status of previous online payments. If youve received unemployment compensation or a state tax refund, youll receive Form 1099-G. Please print the Form 480 and follow the instructions on the form. It requires a $10 Money Order and a notarized signature.

#Unemployment tax form for free#

Get the current filing year’s forms, instructions, and publications for free from the Internal Revenue Service (IRS). Once the 2020 1099G forms are uploaded, PUA claimants can access their PUA-1099G via their.

#Unemployment tax form download#

The Pandemic Unemployment Assistance (PUA) 1099G form will also be made available to download online. If you need any written information on your Unemployment Claim for the purpose If you file your taxes by paper, you’ll need copies of some forms, instructions, and worksheets. Reemployment Trade Adjustment Assistance (FP-1099G form) The 1099G forms for Regular Unemployment Compensation (UC) is now available to download online. Request Written Information on Your Claim Information is posted as soon as possible each January for the most Claimants who received PUA benefits will have a separate 1099. These forms will be mailed to the address that DES has on file for you. Anyone who repaid an overpayment of unemployment benefits to the State of Arizona in 2021 will also receive a 1099-G form. Reported each year even if you have repaid some or all of the benefits DES has mailed 1099-G tax forms to claimants who received unemployment benefits in 2021.

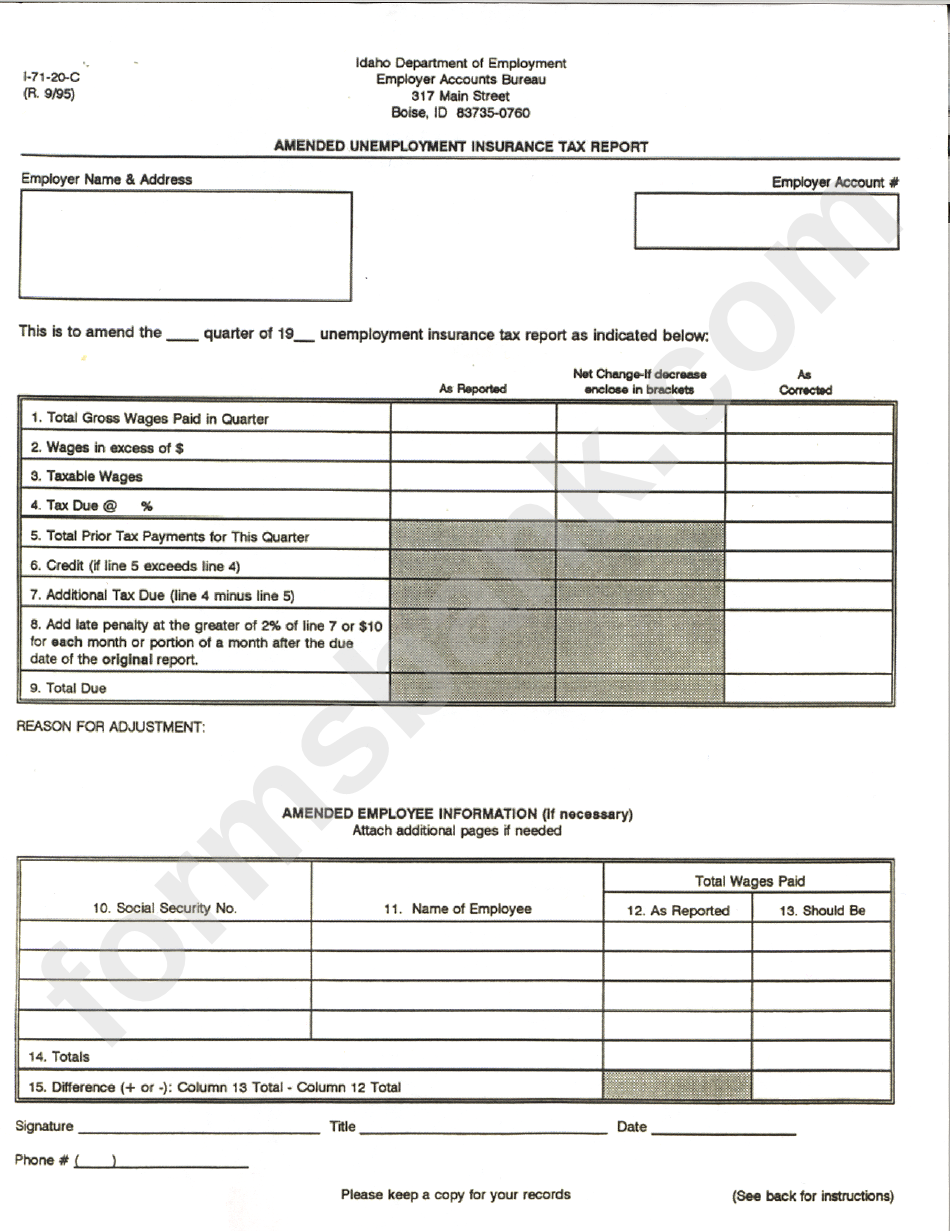

Obtain information about tax withheld from unemployment benefitsĪs well as the amount of benefits paid in the tax year. Experience tax currently capped at 5.4 (RCW 50.29. This taxable wage base is 62,500 in 2022, increasing from 56,500 in 2021. To file a weekly claim certification, change your 4-digit Personal Identification Number (PIN), or view your last five payments, pending weekly claims and other general information about your claim. State Unemployment Taxes (SUTA) An employee’s wages are taxable up to an amount called the taxable wage base, authorized in RCW 50.24.010.

Unemployment Compensation (UC) claim that has previously been established. If you collected unemployment insurance last. The 1099-G form is used to report unemployment compensation on your tax return. To start a new benefit year or to reopen an All individuals who received unemployment insurance (UI) benefits in 2020 will receive the 1099-G tax form. We make nightly changes to the claimant system (MyBenefits Portal) from 11 pm 3 am, and the system will be temporarily unavailable during this time. Establish a New or Reopen an Unemployment Claim (including claims for TAA Benefits and Services) If you received an email asking you to complete a survey and you would like to know more, please call 80 or visit dew.sc.gov/survey.

0 kommentar(er)

0 kommentar(er)